Understanding the Islamic way to buy a home

For Muslims, the idea of paying or receiving interest is not just a personal choice. It is a clear red line set by Islamic teachings. That is why a traditional mortgage, which charges interest on borrowed money, cannot be accepted by those who want to stay fully within Islamic financial principles.

So what is a halaal mortgage? How does it work? And is it really different from a normal mortgage?

This page explains the core concepts in a simple way. You will find out how Islamic mortgages are structured, how they avoid interest, and what makes them valid under shariah law. Whether you are planning to buy your first home or just want to understand your options better, this is a good place to begin.

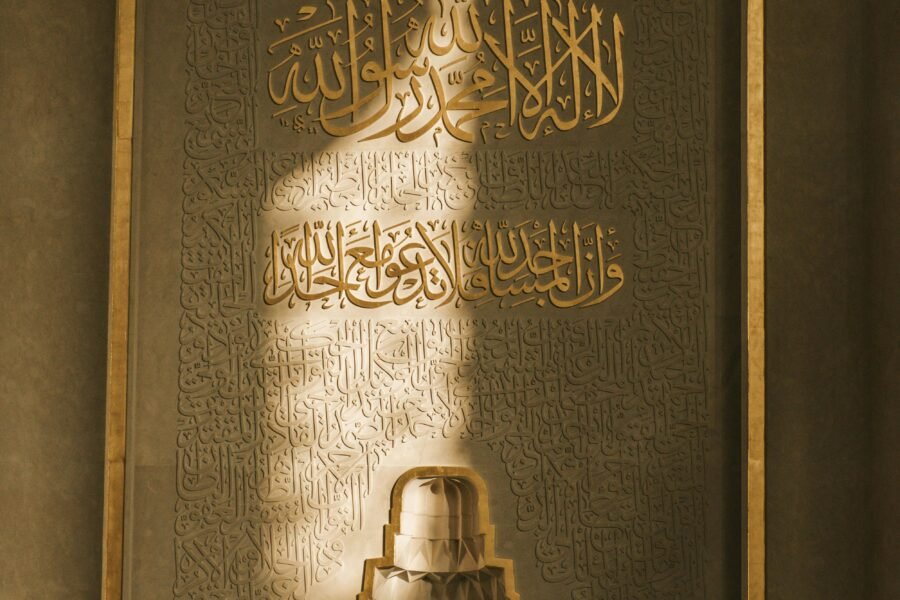

O you who believe, fear Allah and give up what remains of interest, if you are truly believers.

Surah Al-Baqarah, verse 278

A halaal mortgage is not really a mortgage

Let’s start by clearing something up. The term “halaal mortgage” is often used to explain Islamic home finance, but in reality, it is not a mortgage in the traditional sense.

A conventional mortgage is a loan. The bank gives you money, and you repay that money with interest. This structure is based on lending and profiting from debt, which is forbidden in Islam.

In contrast, Islamic home finance is based on trade, partnership or leasing. The bank or provider either buys the house and sells it to you in instalments, or buys the house and rents it to you until you own it. There is no interest involved, and both sides share the risk and responsibility.

What makes a mortgage halaal?

A halaal mortgage must meet key Islamic principles:

- No interest is charged or paid

- The transaction is linked to a real asset (the property)

- The buyer and the provider share risk fairly

- The terms are clear and agreed by both parties

- The contract does not involve exploitation or harm

These rules are designed to keep financial deals ethical, transparent and based on real value. They also make sure that no one is taking advantage of the other through unfair terms or hidden clauses.

The difference is in the structure

While both conventional and Islamic mortgages help you buy a house, the way they work is very different.

In a typical mortgage, the bank does not own the property. It just lends you money and charges interest on the loan. You are the only one at risk.

In a halaal model, the provider is involved in the ownership. You pay for the use of the house (like rent or agreed profit), and over time, your share of the house increases. This makes the agreement more balanced and grounded in Islamic values.

You can explore the different structures in detail on our Types of Islamic Home Finance page.

Why the details matter

Some products are marketed as Islamic but may still include features that do not fully comply with shariah. For example, a contract that hides interest under a different name or one that penalises early payments unfairly might not be truly halaal.

That is why it is important to understand what you are signing. Ask questions. Look for transparency. And check if the provider works with qualified Islamic scholars or shariah boards.

Our Is Your Mortgage Halaal? checklist can help you review any contract before moving forward.

Is it practical in the UK?

Yes. Halaal mortgages have become more available in recent years. Islamic banks and specialist providers now operate in the UK, offering home finance based on shariah principles. These products are available to Muslims and non-Muslims alike and can be used to buy new homes, refinance existing ones or invest in property.

You can use our Compare Providers tool to see what options are available and how they differ.

What is Halaal Mortgage FAQ’s

Yes. But how much of the sale proceeds you keep will depend on how much of the property you own. The terms should explain this clearly from the start.

Rent is a payment for the use of something you do not fully own. Interest is a fee for borrowing money. In Islamic finance, profit comes from asset use or resale, not from debt.

Yes. Islamic home finance models are fully legal in the UK and regulated by the Financial Conduct Authority. The contracts follow both UK legal standards and Islamic guidelines.

True Islamic finance does not charge hidden interest. Instead, it involves profit made through trade or rent. Always check how the payments are structured and whether a qualified scholar has reviewed the product.

In some cases, the payments may be similar, but the structure is different. You are not paying for borrowed money. You are paying for your share in the property or its use.

Most providers will work with you to find a solution. Late fees are sometimes charged to discourage delay, but they are not kept as profit and are often donated to charity if collected.

The goal is to help you own a home in a way that avoids interest, shares risk fairly and keeps your transaction compliant with Islamic principles.

Sign up